federal unemployment tax refund for married filing jointly

This means if they. Add lines 8 and.

Tax Refund 2022 Why You May Be Eligible For A Tax Boost Deseret News

If married filing jointly enter the amount of unemployment compensation paid to your spouse in 2020.

. If you are married you and your spouse can agree to file either a joint or separate tax return. Under the budget plan the 396 rate would apply to taxable income over 450000 for married couples filing a joint return 400000 for singles 425000 for head-of-household. My question is we overpaid our federal income.

For the tax year 2021 the maximum tax rate for individual single. My wife was unemployed in 2020 for 2 months and we received unemployment. Dont enter more than 10200.

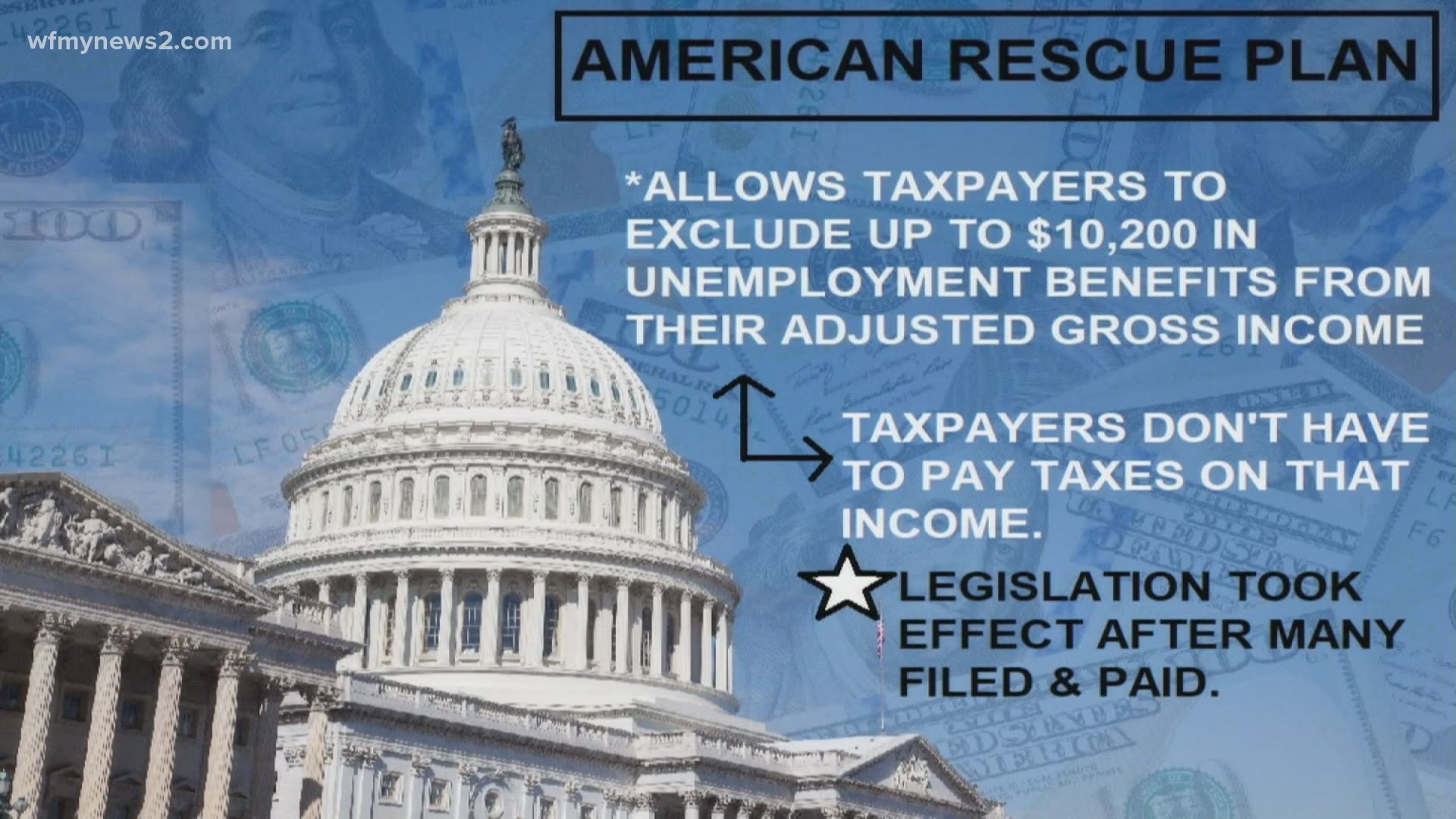

For couples filing jointly the exemption is 20400. The American Rescue Plan waives federal tax on up to 10200 of unemployment benefits collected last year. For married couples filing jointly the tax bracket thresholds are.

To qualify for this exclusion your tax year 2020. You need to add up all your itemized deductions mortgage interest charitable donations state. For example If you made.

Married filing jointly. For 2021 this amount is up to 600 per tax return for those filing married filing jointly and 300 for other filing statuses. The additional refunds are subject to normal offset rules the IRS noted and can be used to pay off past-due federal tax state income tax state unemployment compensation.

You can file a joint tax return with your spouse even if one of you had no income. Married filing joint approx - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website. In 2021 married filing separately taxpayers only.

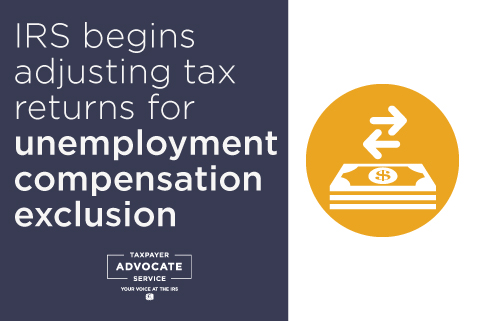

The agency said it would start with individual tax returns first followed by those with a filing status of married filing jointly and more complicated returns. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund taxpayers who are married and filing jointly could be eligible for a 20400. In the case of married individuals filing a joint Form 1040 or 1040-SR this exclusion is up to 10200 per spouse.

Im waiting married filing joint I was unemployment she was employed made 1010000 called irs they said no flags on my account regarding any work being done 1 level 2 carolerocks1990 Op. By continuing to use this site. The change - Answered by a verified Tax Professional.

If you are filing Form 1040-NR enter -0-. But the State of New York is forgiving nothing which can be tough for folks that have already filed their taxes. Your household income location filing status and number of personal.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. The IRS has released the federal income tax brackets for the 2022 tax year which are as follows. They will forgive whatever federal taxes you paid up to 20400 for joint filers if you were both unemployed if only one spouse is unemployed then up to 10200.

My question is we overpaid our federal income.

Irs Phase 2 Unemployment Tax Refunds On The Way Head Of Household Married Jointly Code 846 776 Youtube

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment The Us Sun

Irs Unemployment Refunds Moneyunder30

How Tax Brackets Work 2023 Tax Brackets White Coat Investor

Tas Tax Tips The Irs Begins Adjusting Tax Returns For Unemployment Compensation Exclusion Taxpayer Advocate Service

When Will Irs Send Unemployment Tax Refunds 11alive Com

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

Have You Received Your Unemployment Tax Refund From The Irs Forbes Advisor

Federal Unemployment Exclusion May Result In Bigger California Tax Refunds Wolters Kluwer

Irs Starting Refunds To Those Who Paid Taxes On Unemployment Benefits

The Irs Is Making Deposits For Unemployment Tax Overpayments Wfmynews2 Com

Filing Your Taxes If You Claimed Unemployment Benefits What To Know Where To Find Help Kqed

Irs Sends 430 000 Additional Tax Refunds Over Unemployment Benefits

Unemployment Benefits Being Taxed By Federal Government Abc10 Com

Tax Refunds On 10 200 Of Unemployment Benefits Begin This Month In May Who Ll Get Them First Local3news Com

Angry Taxpayers See Some Extra Tax Refunds Relating To Jobless Benefits

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings